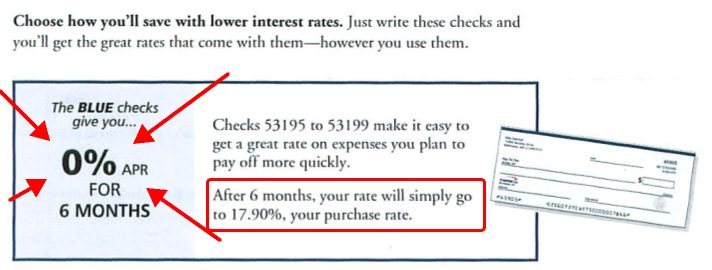

The credit card companies always need to make profits. So they send out all kinds of offers. I recently got an offer that included several “convenience” checks so I can more easily borrow money against my credit card. To make this a really special offer the interest rate is 0% zero percent for 6 months. Sounds great!

But are they being devious? Do they think I’m an idiot? Should I feel insulted?

Apparently the answer is YES to all!

Sure, it clearly says “0% APR” all over it. Sounds like “Free”. But as we all know, the word free means something different to you than it does to the credit card companies and cellphone companies.

How much is that free phone? Yeah, you will spend over $2,000 dollars to get that free phone (estimated based on a 2 year contract at $85/mo).

So how much is this free loan going to cost? More than you think.

Let’s look at the whole story.

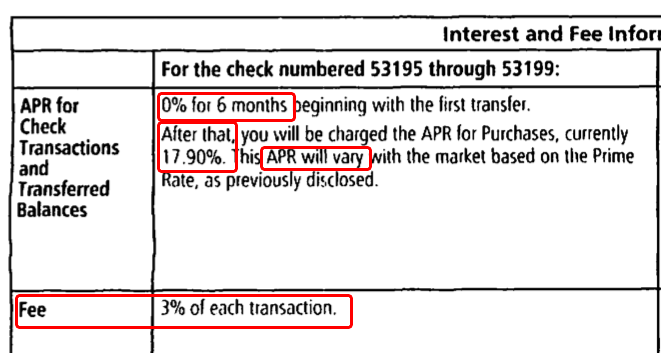

So this FREE loan will cost 3% for starters. And after 6 months the interest rate swells to 17.9%. And that rate can vary. Geez! This is NOT FREE, and it is NOT ZERO percent.

Credit card companies seem to have their own math, so instead of trying to figure it out, I called them to ask how much the 0% loan would cost me. More specifically, I asked if I borrowed $1,000 via one of these checks, and paid only the minimum monthly payments, how much would I have paid at the end of 12 months to completely repay the loan?

It took almost 30 minutes for the rep to figure this out for me. And in the end their numbers didn’t quite add up correctly. So don’t feel bad if you didn’t figure it out yourself.

Here’s how they figure it.

If you use one of these 0% loan checks for $1,000 the transaction fee is 3%, or $30. This is added to the 1st month’s payment. They don’t count it as “interest”.

The minimum monthly payment is 1% of the current account balance (OR $15 , whichever is greater), plus the interest, plus transaction fees, late fees, overlimit fees. In this case, 1% of $1,000 is $10 which is smaller than $15 so the minimum payment is $15… Plus the $30 transaction fee. So the minimum payment in the 1st month is $45. The minimum payment for months 2 to 6 is $15. Then the interest jumps to 17.9% or whatever they want to charge. They did say this is an adjustable interest rate. But, for simplicity, let’s pretend that the interest rate is predictable and fixed at the advertised rates.

|

Month

|

i% /princpl |

Paid

|

Running Bal

|

Interest

|

| 1 | 30/15 | $45 | 985 | 0 |

| 2 | 0/15 | $15 | 970 | 0 |

| 3 | 0/15 | $15 | 955 | 0 |

| 4 | 0/15 | $15 | 940 | 0 |

| 5 | 0/15 | $15 | 925 | 0 |

| 6 | 0/15 | $15 | 910 | 0 |

| 7 | 13.57/1.43 | $15 | 908.57 | 17.90% |

| 8 | 13.56/1.44 | $15 | 907.13 | 17.90% |

| 9 | 13.53/1.47 | $15 | 905.66 | 17.90% |

| 10 | 13.51/1.49 | $15 | 904.17 | 17.90% |

| 11 | 13.48/1.52 | $15 | 902.65 | 17.90% |

| 12 | $916.12 | 0 | 17.90% | |

| TOTAL | $1,111.12 |

So at the end of 12 months you will have paid $111.12 in interest & fees on this “Free” $1,000 loan. That looks like an APR of 11.1% to me.

But I figured it for 12 months to see what it would cost for a full year. That is a way to compare it to other options on an annual basis. The term of this zero percent loan offer is 6 months.

So how much does the free 6 month loan cost?

Remember that 3% transaction fee? You can bet they didn’t forget it! If you borrow the money for only 6 months, and you make the minimum payments of $45 in the 1st month, and $15 for months 2-5, then pay the balance off in month 6, you will get the full benefit, the cheapest deal, and only pay 3%. ($30) Which of course is still NOT FREE, and NOT ZERO percent.

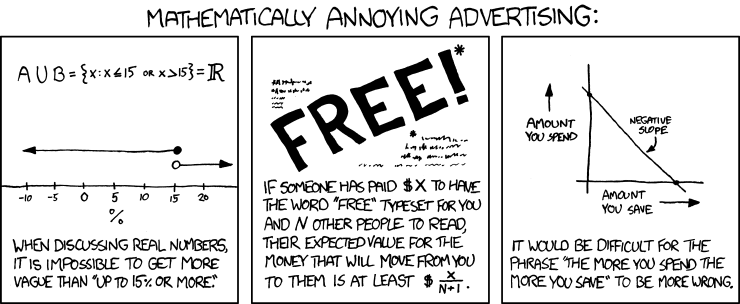

The really important takeaway from this is that when the credit card companies say the Annual Percentage Rate (APR) is zero, they really mean “zero plus some fees“. In this case they mean “at least 3%.” Which also goes to show that you can’t legislate ethical behavior. Regulation is just something they work around to continue their devious tricks.

Don’t be fooled, just feel insulted that they thought you were dumb enough to fall for their tricks.

Here is a great comment from the guy at XKCD. Click the comic for more of his cartoons.

Interesting. Very clear.

Hope you put link on facebook and twitter.

I plan to share it if that’s ok w/ you.

How would that work with your copyright? Do I need your consent or just give you credit?

Thanks.

Glad you liked it. Ok to quote w/o consent. Link back appreciated but not essential. :-)

Excellent post. Elizabeth Warren and you would make a great team!

Great post, Dave.

Everyone should be skeptical of credit card offers that seem too good to be true. The best defense is a vigilant consumer.

The worst defense is government protecting us from our own folly. A false safety net is more dangerous than no safety net because it dulls our own sense of responsibility.

I have what I consider a great credit card service from my Credit Union, and recommend everyone take advantage of that kind of low-interest, consumer-friendly opportunity.